TheNewswire – 06 August 2021 – Altus Strategies Plc (AIM:ALS) (TSXV:ALTS) (OTC:ALTUF) announces the completion of the first phase of a long-term Community Development Programme (“CDP”) at the Company’s 100% owned Diba gold project (“Diba” or the “Project”) in western Mali.

Highlights:

-

– Long-term Community Development Programme at Diba Gold Project in western Mali

– CDP initially focused on public health and education projects

– Phase one completed, providing safe drinking water to the local village and school

– CDP is the foundation for the long-term and sustainable investment in local communities

– Further project phases for 2021 and 2022 are currently being planned

Steven Poulton, Chief Executive of Altus, commented:

“Long-term and sustainable investment in the local communities where we operate is core to our business at Altus. We are delighted to have completed the first phase of our Community Development Programme at the Diba gold project in western Mali. This work has included the provision of safe, tapped drinking water to the local school and to the village of Koropoto, 2km east of the Diba deposit. The project involved drilling a 72.5m borehole, construction of a 12m high water tank with a solar-powered water pump and installation of all other necessary infrastructure. The CDP at Diba is initially focused on the two priority areas of health and education, and builds on our existing strong ties to the local community from which many of our staff are employed. I look forward to updating shareholders on this work, as well as on the current drilling programme at Diba, in due course.”

Community Development Plan

Altus has completed the first phase of the CDP at Diba. The nearest community to Diba is Koropoto village, located approximately 2km to the east of the Project, outside of the current licence area. In time the CDP programme will be extended to other communities in the surrounding area.

Altus undertook a consultation process with representatives of the local communities to Diba in order to prioritise the CDPs that would be most impactful. The consultation identified critical themes in health and education, which are the current focus for the CDP. Following consultation with the residents of Koropoto, the specialist environmental company, EBEF-Mali, was commissioned to install a low-maintenance system to provide safe drinking water on tap to the local school and village.

Illustrations

The following figures relate to the disclosures in this announcement and are visible in the version of this announcement on the Company’s website (www.altus-strategies.com) or in PDF format by following this link: https://altus-strategies.com/site/assets/files/5328/altus_nr_-_diba_cdp-_06_august_2021.pdf

-

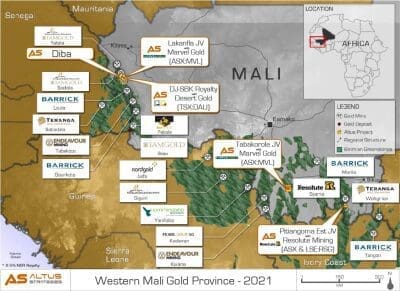

– Location of the Diba gold project in western Mali is shown in Figure 1.

– Selection of photos of CDP Phase 1 at Koropoto village near Diba is shown in Figure 2.

Figure 1: Location of the Diba gold project in western Mali

Figure 2: Selection of photos of CDP Phase 1 at Koropoto village near Diba

Diba Project: Location

The 81km2 Diba project (Korali Sud licence) is located in the Kayes region of western Mali, approximately 450km northwest of the capital city of Bamako. The Project sits 5km west of the Company’s Lakanfla gold project, which is under joint venture with ASX-listed Marvel Gold Limited, and approximately 13km south of the multi-million ounce Sadiola gold mine and 35km south of the multi-million ounce Yatela former gold mine, both owned by Allied Gold Corp. Diba is contiguous with the Sadiola permit on its northern and eastern boundaries. Mineralisation hosted on these properties is not necessarily indicative of mineralisation hosted at Diba.

Diba Mineral Resource Estimate

Diba hosts a deposit for which a mineral resource estimate (“MRE”) of 217,000 ounces at 1.39 g/t gold (Indicated) and 187,000 ounces at 1.06 g/t gold (Inferred) in both oxide and fresh domains has been made, as set out in Table 1. The MRE was previously reported by the Company on 6 July 2020 (see Altus’ news release titled “Significant Gold Resource at Diba Project, Western Mali”). The Diba deposit remains open down dip and along strike.

Table 1: Diba Mineral Resource Estimate

|

Domain |

Indicated |

Inferred |

||||

|

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

|

|

Oxide |

3,900,000 |

1.46 |

183,100 |

939,000 |

1.10 |

33,200 |

|

Fresh |

934,000 |

1.12 |

33,600 |

4,540,000 |

1.05 |

153,300 |

|

Total |

4,834,000 |

1.39 |

217,000 |

5,479,000 |

1.06 |

187,000 |

Notes:

-

– The MRE has an effective date of 6 July 2020.

– The Mineral Resources in the MRE are classified according to the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) "Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines" dated 29 November, 2019 and CIM "Definition Standards for Mineral Resources and Mineral Reserves" dated 10 May, 2014.

– Mineral Resources are reported within a pit shell and are reported to a base-case cut-off grade of 0.5 g/t gold.

– The quantity and grade of Inferred Resources in the MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Resource category.

– Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The MRE may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

– All tonnages reported are dry metric tonnes. Minor discrepancies may occur due to rounding to appropriate significant figures.

– Tonnages are rounded to 1,000t and gold to 1,000oz as this is an estimate.

– Altus Strategies is the operator and 100% owner of Diba.

Diba Deposit: Geology and Mineralisation

Mineralisation at Diba is sediment-hosted within a series of stacked lenses, typically between 20m and 40m thick. The lenses are shallow-dipping at approximately 30 degrees angled to the east/east-southeast. The Diba deposit is considered to be controlled by a number of northwest and northeast orientated structures, with gold occurring as fine-grained disseminations in localised high-grade, calcite-quartz veinlets. Alteration at Diba is typically albite-hematite+/-pyrite, although pyrite content is generally very low (<1 %). The weathering profile at the Project is estimated to be up to 70m vertical depth, resulting in extensive oxidation from surface. The oxide gold mineralisation at the Diba deposit is predominantly found in saprolite within 50m of surface and across a compact 700m x 700m area.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master’s degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

|

Altus Strategies Plc Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767 E-mail: [email protected] |

|

SP Angel (Nominated Adviser) Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

SP Angel (Broker) Grant Barker / Richard Parlons |

Tel: +44 (0) 20 3470 0471 |

|

Shard Capital (Broker) Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

|

Yellow Jersey PR (Financial PR & IR) Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512 E-mail: [email protected] |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s focus on Africa and differentiated approach, of generating royalties on its own discoveries as well as through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law or regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organisation of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

Glossary of Terms

The following is a glossary of technical terms:

“Au” means gold

“CIM” means the Canadian Institute of Mining, Metallurgy and Petroleum

“CDP” means Community Development Programme

“g” means grams

“g/t” means grams per tonne

“grade(s)” means the quantity of ore or metal in a specified quantity of rock

“km” means kilometres

“km2” means square kilometres

“m” means metres

“MRE” means Mineral Resource Estimate

“NI 43-101” means National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators

“Qualified Person” means a person that has the education, skills and professional credentials to qualify as a qualified person under NI 43-101

“t” means a metric tonne

Altus Strategies Plc / Index (EPIC): AIM (ALS) TSX-V (ALTS) OTCQX (ALTUF) / Sector: Mining

Copyright (c) 2021 TheNewswire – All rights reserved.